Product depreciation calculator

The average car depreciation rate is 14. Depreciation for Year 2 Rs350000.

Furniture Depreciation Calculator Calculator Academy

It may be home appreciation investments or anything else you need but first you need to know how to calculate appreciation and what it isRemember that if the value of your product decreases over time you may use the depreciation calculator or use a negative appreciation.

. Leave blank if there is a CEVS surcharge. Road Tax Calculator. A decrease in an assets value may be caused by a number of other factors as well such as unfavorable market conditions etc.

Machinery equipment currency are. The appreciation calculator is a tool that helps you find the future value of anything. The monetary value of an asset decreases over time due to use wear and tear or obsolescence.

Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. The actual cash value is the difference between the replacement cost and the depreciation cost. A P 1 - R100 n.

Assume a depreciation rate of 30 after the first year and 20 each consecutive year. These benefits are in accelerated depreciation which allows a business to take more expenses in the first year of owning and using an asset. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

Free Online calculator for quick calculations along with a large range of online calculators on math statistics finance technology and more each with related in-depth information. The replacement cash value is the current cost of the product in the market ie the cost required to replace the item you own with a new one at present. D P - A.

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years. Product Cost Formula Calculator.

On the basis of the production cost per unit the pricing of the final finished product can be determined. For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. The actual cash value is the value of an appliance after considering depreciation due to wear and tear.

Moffsoft Calculator 2 is powerful feature-rich calculator software with a simple easy-to-use interface. In addition to the printable and savable calculator tape youll discover powerful financial functions unit conversions date and time calculations product pricing functions floating and fixed point decimals multiple memory values. S CEVS Rebate.

The Car Depreciation Calculator uses the following formulae. S Reg Date. Depreciation to be charged from Year 2 onwards is Rs350000.

The Tax Cuts and Jobs Act 2017 allows more generous depreciation benefits to businesses to buy capital assets. Accelerated depreciation benefits are categorized in two ways. Input details to get depreciation.

On the other hand if you want to use Kelly Blue Book see the instructions that appear at the end of this post Line 11. To calculate the impact of depreciation compare an example for a commercial truck worth 100000. To use the calculators depreciation formula on line 10 enter the total price you paid for your new or used vehicle including sales tax.

In this way we can conclude that with the revision in estimates of the useful life of assets and Residual Value the Depreciation amount also gets revised keeping the amount to be charged as depreciation constant every year. As far as accounting is concerned the product costs of the sold products are captured in the income statement while that of the unsold product is reflected in the inventory of finished goods. CEVS rebate is only applicable for cars registered after 1-Jan-2013.

This decrease is measured as depreciation.

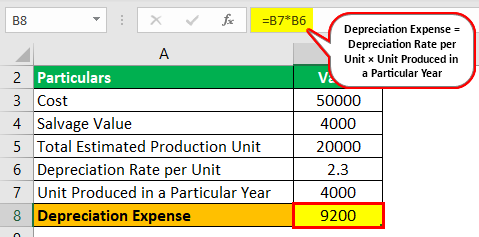

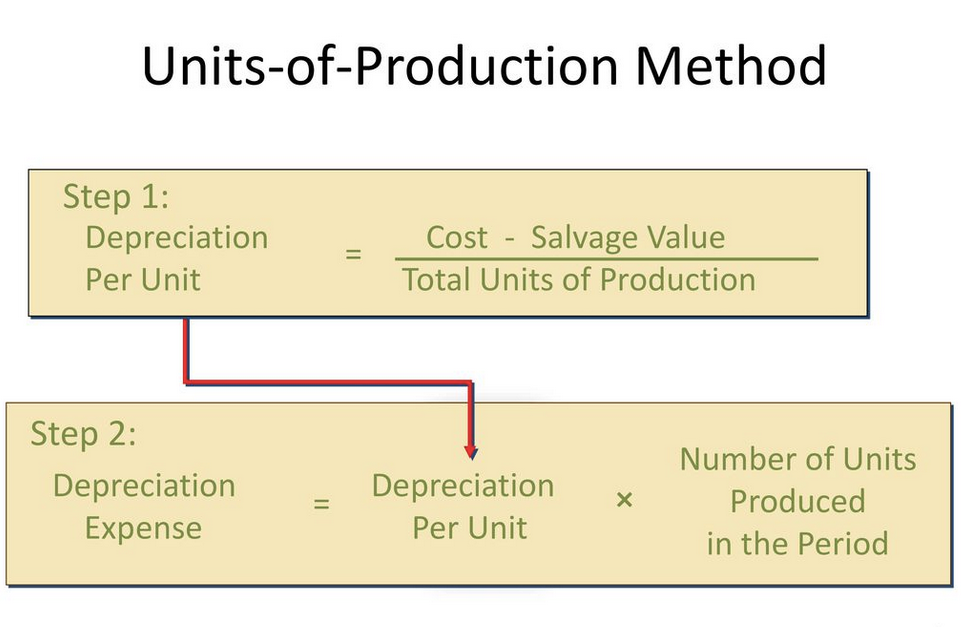

Unit Of Production Depreciation Method Formula Examples

How Do I Calculate Depreciation Formula Guides Examaples

Depreciation Calculator Store 60 Off Www Wtashows Com

Calculating Depreciation Unit Of Production Method

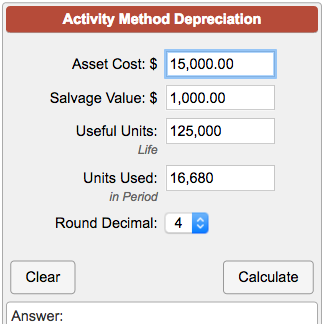

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Store 60 Off Www Wtashows Com

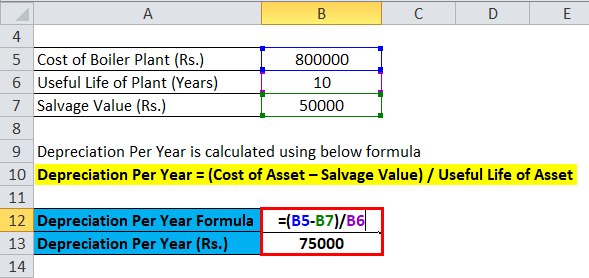

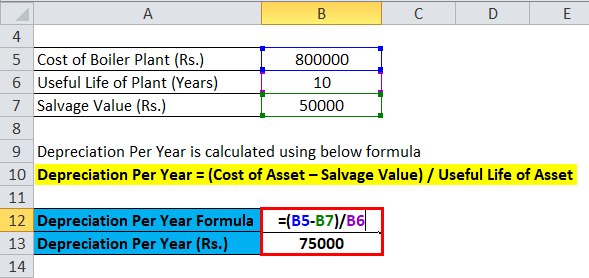

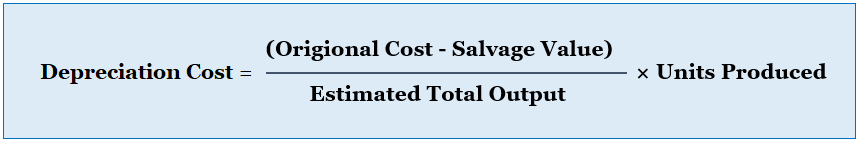

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

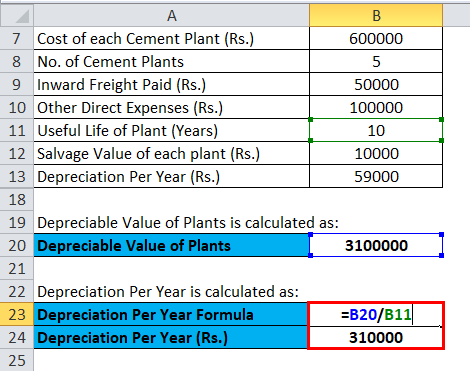

Depreciation Formula Examples With Excel Template

Depreciation Calculator Online 60 Off Www Wtashows Com

Units Of Production Depreciation Calculator Efinancemanagement

Depreciation Calculator Shop 58 Off Www Wtashows Com

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Store 60 Off Www Wtashows Com

Depreciation Formula Examples With Excel Template

The Units Of Production Method Of Depreciation Part 1 Of 2 Youtube